Unlocking the Power of Audience Demand Data

Executive Summary

In today's rapidly evolving digital landscape, the ability to measure and understand audience demand has become a critical tool for content creators, distributors and content sales. As audience consumption habits become more fragmented and diverse, traditional metrics such as box office sales, TV ratings, and even streaming numbers fail to capture the full scope of media engagement. To address this challenge, new data sources that measure global content consumption are emerging as a powerful means to provide insights into the real demand for content.

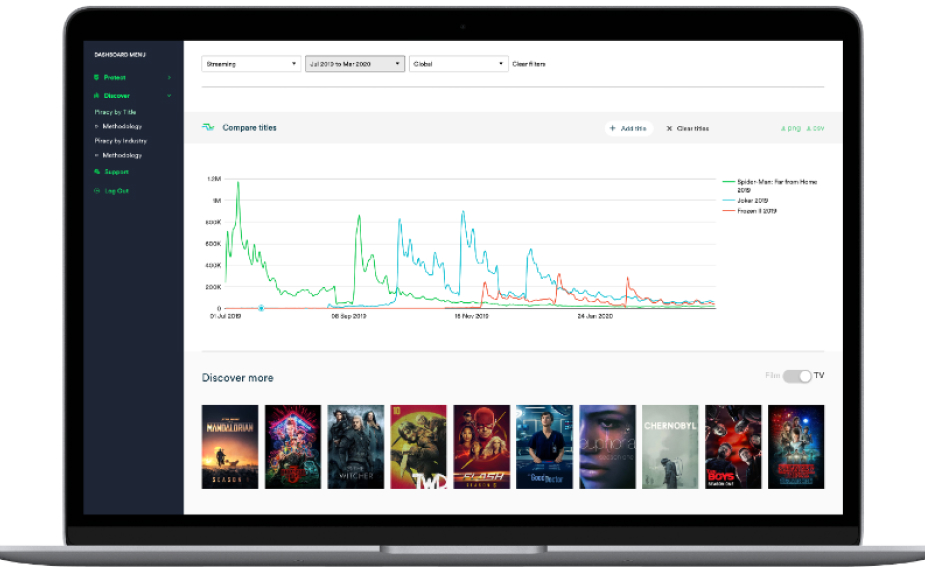

This report focuses on Audience Demand data from MUSO's Discover platform, which tracks unlicensed audience engagement across streaming and download platforms globally. By capturing data from these alternative channels, MUSO provides content teams with a broader, more granular view of audience demand. This offers critical insights into global content consumption, revealing significant opportunities for content distribution in markets where traditional measures are lacking or incomplete.

The report highlights key trends and use cases for leveraging audience demand data:

- Genre Demand: Genre insights enable companies to identify and target niche audiences more effectively.

- Regional Insights: Geographical demand data demonstrates the potential for strategic content distribution that traditional metrics may overlook.

- Talent Affinity: Understanding where specific actors or directors drive higher demand offers valuable insights for content sales and acquisitions, enabling more informed sales decisions.

Ultimately, with critical insights on audience behaviours, content creators and distributors can make more data-driven decisions, maximizing their reach and revenue in an increasingly competitive media environment.

Section 1. Audience Demand Data is the New Currency for Content Owners.

Introduction

In today's digital age, understanding audience demand has become more critical than ever for content creators, producers, and distributors. With countless platforms and endless streams of content, knowing where and how your audience engages with content is the key to staying ahead in a fiercely competitive landscape.

The Shifting Landscape of Audience Consumption

As consumption habits evolve, so too does the need for more nuanced and comprehensive data to drive content strategy. Today’s audiences are no longer confined to legal streaming platforms or broadcast schedules; they seek out content wherever it is available, often outside of traditional channels and using methods which are not typically measured resulting in a significant portion of viewer activity that remains unseen by traditional metrics.

This fragmented consumption behaviour poses a challenge: how can content creators and rights holders capture the full scope of audience demand?

A Truer View of Audience Demand

Traditional metrics like box office sales, television ratings, or even streaming numbers only tell part of the story. Outside of traditional channels, another vast hidden global audience exists, consuming content unrestricted by platform or geography.

Unlicensed audience demand offers insights into a massive content-consuming audience that traditional measures miss, and who are high intent consumers with a higher propensity to pay for home entertainment and theatrical visits. By capturing data from myriad unauthorised platforms, we can get a comprehensive view of what audiences are truly engaging with, giving media and entertainment companies granular insights into global content consumption.

A New Measurement Methodology

The unlicensed ecosystem is arguably the largest Video on-Demand platform in the world with audiences unrestricted by platform, geography or cost. The resulting data offers the entertainment industry a near real-time, holistic view of global audience demand, enabling media companies to drive more value from their content.

MUSO’s Discover platform tracks and measures daily global audience engagement across unlicensed consumption channels, including streaming and downloads. The platform tracks audience demand for over 800,000 film and TV titles worldwide, giving content creators and distributors an edge by revealing demand for content that no other platform measures in regions where content may not yet be officially available.

Moreover, MUSO Discover data extends beyond just tracking where content is being accessed—it also provides valuable insights into when and how. By analysing peak consumption times, preferred channels, geography and genres, MUSO’s data provides deep analysis into the audience and affinity of content.

For distributors and sales agents, this data is invaluable to inform decisions about buying and selling content.

"Knowing where and how your audience engages with content is the key to staying ahead in a fiercely competitive landscape."

Section 2. Turning Demand Data into Actionable Insights.

2.1. Key Insights and Use Cases

MUSO Discover offers a unique perspective on global content viewing habits. Below are some examples of how the Discover Demand dataset gives content creators and distributors the data they need to make informed decisions in an increasingly fragmented media landscape.

2.1.1. See In-Demand Genres

When analysing demand across TV genres over the last 365 days, anime emerges as a clear leader (Chart 1a). Although the genre ranked seventh in overall demand for 2023 (Chart 1b), anime holds the highest average demand per title, with over 3,300 titles averaging more than 814,000 streams and downloads each.

This trend is driven by specific subgenres like Isekai (alternate worlds) and fantasy, often based on light novels. Anime’s concentrated but loyal audience presents an opportunity for media companies looking to tap into dedicated fanbases that drive high engagement.

Chart 1a. Average demand by title by genre.

Chart 1b. Total demand for TV genres.

Taking the horror genre as an example, we can drill into sub-genres at a regional level (chart 2). Monster Movies (including the sub genres of Creature Feature and Kaiju) are currently in the highest demand (driven by big films like Godzilla Minus One, Under Paris and No Way Up) with Supernatural films remaining a consistently popular genre. Furthermore, we can apply heatmaps to track subgenre trends over time enabling content creators to identify and cater to shifts in audience tastes, making it easier to penetrate international markets.

Chart 2. A breakdown of the most in-demand Horror sub-genres by region.

2.1.2. Geographical & Regional Demand

A deeper dive into geographical demand reveals untapped opportunities for sales agents and distributors.

Unlike traditional box office data, MUSO Discover provides real-time, global insights into unlicensed content consumption. For example, U.S. audiences account for over 16% of the total film demand, making it the largest regional market (chart 3). This is not surprising, however, emerging markets like South America, where countries like Peru and Colombia show over-indexed demand for blockbuster films, are prime candidates for content distribution strategies.

Chart 3. Total film demand ranked by region.

The Discover dataset can also highlight geographical demand for very specific content types that are aligned to a client’s title that they’re selling into these markets as in chart 4 below.

.png?width=850&height=350&name=Psychological%20drama%20(1).png)

Chart 4. Demand for psychological drama series in key markets

Psychological drama TV series significantly over perform against other TV series in key markets, with Australia, the Arab Emirates, France and Canada leading the way, showing an exceptional global appetite for this genre.

2.1.3. Talent Demand

This is also true for talent. Where titles have a high-profile actor or director, unlicensed demand can illustrate where that specific talent over-indexes in demand for given territories (chart 5).

%20(1).png?width=850&height=350&name=piracy_by_title-piracy_demand_index_per_country%20(9)%20(1).png)

Chart 5. Regional demand for titles starring Jessica Alba.

The demand for titles featuring Jessica Alba highlight substantial international demand, indicating exceptionally strong market potential and valuable opportunities in countries such as Canada, Thailand and the Netherlands, where demand significantly exceeds the global average.

These insights are invaluable for sales agents pitching to regional markets, as they allow for strategic tailoring of pitch decks and marketing materials based on real-time data, not just historical performance.

2.1.4. Affinity Scores & Talent Demand

Affinity scores are another essential tool for understanding audience overlap between titles at a regional level. For instance, there is a strong affinity between The Last of Us and Tales of the Walking Dead in the UK, with nearly 27% of Tales of the Walking Dead viewers also watching The Last of Us (chart 6). This type of data can guide content marketing, acquisitions, and licensing decisions by helping media companies focus on audiences most likely to engage with similar content.

Chart 6. Titles with demand affinity with The Last of Us 2023.

Moreover, MUSO Discover’s keyword and talent demand insights allow content creators and distributors to assess the geographic draw of specific actors. Soon, a dedicated Talent Report will provide deeper analysis, making it easier to evaluate casting decisions and regional marketing strategies based on which stars resonate most with particular audiences.

2.2. USE CASE: Film Sales and Acquisition

Sales teams looking to maximise and demonstrate the value of their content at a franchise or new title level are able to utilise demand indexing within key territories to supercharge their sales pitch, whilst reducing risk for acquisitions teams.

Looking at demand for future films in the Saw series as an example, we can see that by using a control group of all of the Saw franchise titles, that current demand over the last 12 months in the below major territories demonstrates there is still huge demand (chart 7).

Chart 7. Demand for the Psychological Drama genre in key markets.

The United States over indexes by 2.49 times the global average (or your average internet accessible American is 149% more likely to watch a Saw film than your global average internet accessible citizen) or your average Irish citizen is 403% more likely to.

Traditional box office data is outdated for this purpose - many of these films are 15+ years old and no longer have relevant box office data. Utilising MUSO’s dataset to demonstrate demand with current data is a powerful tool to support both sales and acquisition.

Summary

Audience Demand Insights: The Future of Content Strategy

As the media landscape continues to evolve, the importance of understanding audience demand cannot be overstated. With the rise of global streaming services and the increasing ease of access to content, the power has shifted firmly into the hands of the audience. Those who can accurately gauge and respond to this demand will lead the industry.

MUSO Discover is at the forefront of this shift, providing the tools necessary to navigate the complex world of digital content consumption. By enabling a comprehensive view of audience behaviour, MUSO Discover empowers content owners to make informed decisions that drive engagement, increase revenue, and protect intellectual property.

MUSO Discover is more than just an analytics tool—it's a window into the future of audience demand. As content consumption continues to diversify and expand, tools like Discover will be essential for anyone looking to thrive in the modern media landscape.

Taking the next steps in Audience Demand Measurement

If you are looking to take your audience measurement strategy to the next level, MUSO Discover offers the tools and data to ensure your efforts are both impactful and measurable.

Visit muso.com/discover for more information, or contact our Data and Insights team to discover how MUSO Discover can help maximise the value of your content today.

About MUSO

For over a decade, MUSO, a leader in global content analytics, has been at the forefront of providing data-driven insights to the world’s largest media and entertainment companies.

With a proven track record of empowering rights holders to measure and derive value from unlicensed audiences, MUSO’s suite of solutions— including MUSO Discover—continues to set the standard in audience demand measurement and revolutionise how we understand and respond to audience demand.

Take the Next Steps in Audience Demand Measurement

Talk with our Experts

If you are looking to take your audience measurement strategy to the next level, MUSO Discover offers the tools and data to ensure your efforts are both impactful and measurable.

Visit muso.com/discover for more information, or contact our Data and Insights team to discover how MUSO Discover can help maximise the value of your content today.